The article examines how companies and banks meet liquidity regulations like Basel III, Liquidity Coverage Ratio (LCR), and Net Stable Funding Ratio (NSFR). It highlights three case studies - Apple, Walmart, and mid-sized U.S. banks - and their approaches to staying compliant. Here's what you need to know:

- Apple: Enhanced short-term liquidity management using treasury systems and real-time cash forecasting to align with LCR principles.

- Walmart: Centralized global cash management and advanced forecasting tools to ensure long-term funding stability in line with NSFR.

- Mid-Sized Banks: Focused on building cash reserves, outsourcing cash flow systems, and addressing governance gaps after challenges like the Silicon Valley Bank collapse.

Quick Takeaways:

- Technology is key: Real-time systems and forecasting tools improve cash visibility and regulatory reporting.

- Governance matters: Poor oversight, as seen in SVB's failure, underscores the need for robust risk management.

- Diversify funding: Relying on one funding source increases vulnerability in volatile markets.

These strategies show how businesses and banks can navigate complex regulations while preparing for future liquidity challenges.

Adapting to LCR and NSFR under Basel III

sbb-itb-97f6a47

Case Study: Apple Inc. Achieving LCR Compliance

This case study highlights how Apple Inc., a leading tech company, has embraced principles inspired by the Liquidity Coverage Ratio (LCR) to refine its liquidity management practices.

Although Apple isn't a bank, the company has integrated LCR-aligned strategies to ensure it can meet short-term cash obligations across its global operations. By leveraging advanced treasury tools and adopting forward-thinking approaches, Apple has enhanced its financial agility.

Adopting Treasury Management Systems

To maintain a clear picture of its global cash reserves, Apple implemented advanced treasury management systems. These systems classify liquid assets according to LCR standards, such as Level 1 assets (cash and central bank reserves) and Level 2 assets, which are subject to specific discounts or "haircuts". Automating this classification process enables Apple's treasury team to identify eligible assets quickly, optimize liquidity portfolios, and reduce the risks tied to manual tracking and errors.

Real-Time Cash Forecasting

Apple transitioned from static liquidity reporting to a dynamic, real-time cash forecasting model. This shift allows the company to generate detailed cash flow projections daily, offering greater transparency into the assumptions and models that underpin its financial planning. With real-time monitoring, Apple's treasury team can anticipate cash requirements more effectively and adapt swiftly to changing market conditions.

Results and Outcomes

While Apple hasn't disclosed specific performance metrics, the adoption of advanced treasury systems and dynamic forecasting has significantly enhanced its liquidity management. These tools likely enable the company to allocate liquid assets more efficiently, improving its ability to navigate unpredictable market challenges with confidence and precision.

Case Study: Walmart Inc. Centralized Cash Management for NSFR

Walmart, a retail giant with around 2.1 million employees and $681 billion in revenue for fiscal year 2025, has developed sophisticated strategies to manage its liquidity. By adopting approaches inspired by the Net Stable Funding Ratio (NSFR), Walmart ensures its financial stability over the long term. Let’s take a closer look at how they’ve implemented this centralized strategy.

Global Cash Pooling

Walmart has embraced a centralized system for managing liquidity across its global operations. This setup allows the company to track cash flow exposures in real-time while addressing transfer restrictions between legal entities and jurisdictions. By pooling cash into a central system, resources are allocated more effectively - minimizing idle funds in some regions while meeting funding needs in others. This strategy aligns with NSFR principles, ensuring that Available Stable Funding (ASF) consistently meets or exceeds Required Stable Funding (RSF).

Forecasting Models for Stability

To maintain stability, Walmart has invested in advanced forecasting tools. For example, Sam’s Club implemented a Centralized Forecasting Service (CFS) on Google Cloud, which consolidates data access across various departments. Walmart also leverages a multi-horizon recurrent neural network to analyze past demand trends, planned events, and global market conditions, enabling them to predict future cash flow needs with precision. Indira Uppuluri, Walmart’s SVP of Supply Chain Technology, highlighted the effectiveness of this approach:

"By using this model for demand prediction, we can plan inventory levels across our network more accurately and well in advance".

In addition, Walmart’s AI platform, Element, ensures rigorous data governance while scaling machine learning applications. These tools collectively enhance liquidity management, as discussed below.

Impact on Liquidity Compliance

The integration of these centralized systems has significantly improved Walmart's operational efficiency. For instance, its conversational AI platform handles over 3 million daily queries from 900,000 weekly users. By unifying forecasting and cash management processes, Walmart has reduced dependency on error-prone, manual spreadsheet-based methods. This streamlined approach not only bolsters operational stability but also aligns with NSFR guidelines, creating a more resilient funding structure.

Case Study: Mid-Sized US Banks and Basel III Adaptation

When it came to adapting to liquidity challenges and Basel III compliance, mid-sized U.S. banks (those with assets between $100 billion and $250 billion) had to navigate a unique set of hurdles. The collapse of Silicon Valley Bank (SVB) in March 2023 exposed vulnerabilities in these institutions, particularly those exempted from stricter regulations under the 2019 Tailoring Rules. Unlike the largest banks, which could afford extensive compliance infrastructure, mid-sized banks had to adopt more strategic approaches. These pressures forced them to strengthen their cash reserves and overhaul their reporting and operational systems to stay resilient.

Building Cash Reserves

The Liquidity Coverage Ratio (LCR), which became fully effective on January 1, 2019, required banks to maintain a sufficient stock of high-quality liquid assets (HQLA) to endure a 30-day stress scenario. This regulation compelled mid-sized banks to rethink their balance sheet strategies entirely. As the Basel Committee on Banking Supervision outlined:

"The LCR promotes the short-term resilience of a bank's liquidity risk profile. It does this by ensuring that a bank has an adequate stock of unencumbered high-quality liquid assets (HQLA) that can be converted into cash easily and immediately."

The collapse of SVB highlighted the dangers of holding large volumes of illiquid assets, especially in a rising interest rate environment. Despite having $211 billion in assets, SVB held approximately $120 billion in mortgage-backed securities that became difficult to liquidate. On March 8, 2023, the bank disclosed a $1.8 billion loss after selling $21 billion in securities, triggering withdrawal requests totaling $42 billion in just one day. Its concentrated client base in the tech and venture capital sectors exacerbated the problem, as deposits disappeared almost simultaneously - a risk traditional frameworks hadn't fully anticipated.

Outsourcing Cash Management

Another challenge for mid-sized banks was meeting the granular reporting requirements of FR 2052a, introduced in 2014. This regulation demanded detailed, contract-level cash flow data, moving away from the aggregated monthly reports that banks had relied on for decades. Many institutions found their legacy systems inadequate for this level of detail. Brad Bruckschen, Director of Balance Sheet Management Product Strategy at Oracle, explained:

"Many banks found their existing solutions incapable of producing granular, instrument-level cashflows promptly."

To address this, a leading U.S. regional bank with over $120 billion in assets partnered with Oracle in early 2014. Under the leadership of Consulting Director Sanjay Naga, the bank achieved FR 2052a compliance within six weeks. By integrating funds transfer pricing and general ledger data into a new Asset-Liability Management (ALM) cash flow engine, the bank processed 1 billion cash flows daily in about three hours, all while reducing overall costs.

| Feature | Traditional In-House Approach | Outsourced Vendor Approach |

|---|---|---|

| Implementation Time | Several months to years | 6 weeks to 2 months |

| Data Granularity | Static/aggregate level | Contract/instrument level |

| Processing Volume | Limited by legacy hardware | 1 billion+ cashflows daily |

| Audit Readiness | Manual data tracing | Automated data lineage |

This shift not only improved compliance but also reinforced governance and risk management practices.

Lessons Learned

The most successful mid-sized banks combined advanced technology with stronger governance. While technology upgrades were vital, they weren't sufficient on their own. SVB's collapse revealed glaring governance failures: the bank operated without a Chief Risk Officer for eight months and failed to hedge against interest rate risks. As the Journal of Banking Regulation noted:

"SVB's failure showed that risk governance and regulatory oversight simply failed. Over-reliance on uninsured deposits, no hedging for interest rate risks, and poor response to management were among the principal causes."

For mid-sized banks, the key takeaways were clear. They needed to diversify funding sources to avoid reliance on concentrated deposit bases, conduct stress tests that accounted for modern risks like social media-driven bank runs, and ensure permanent, effective risk oversight. The SVB crisis demonstrated that traditional 30-day stress scenarios no longer suffice in a world where $42 billion can vanish in a single day. Those banks that embraced advanced cash flow modeling alongside proactive governance positioned themselves to navigate both regulatory demands and market volatility effectively.

Lessons and Comparative Analysis

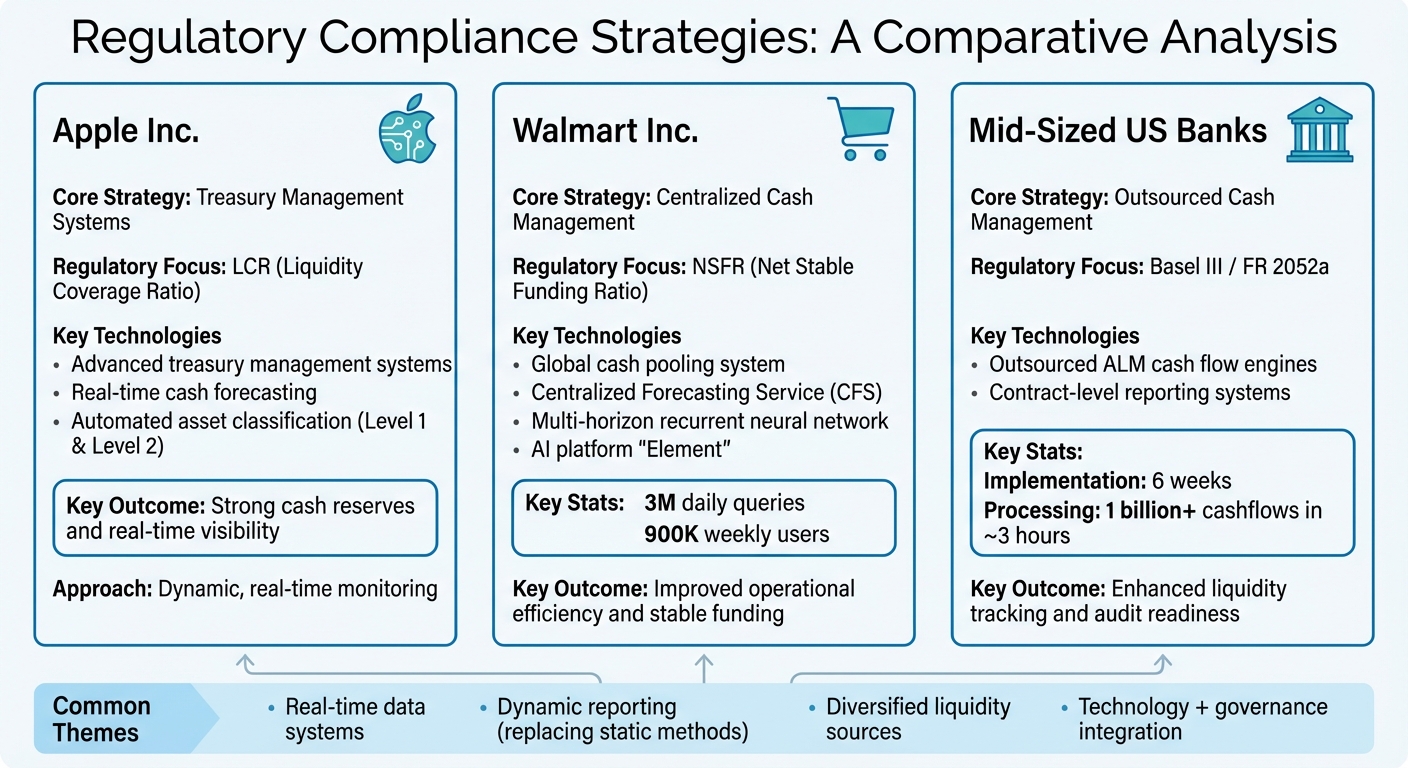

Liquidity Compliance Strategies: Apple, Walmart, and Mid-Sized Banks Comparison

Common Themes Across Case Studies

Examining these case studies reveals three recurring patterns: the adoption of advanced technology, dynamic data management, and diversification of liquidity sources. Whether it’s Apple’s treasury management systems, Walmart’s centralized cash platforms, or mid-sized banks utilizing outsourced ALM engines, these organizations transitioned from outdated, static reporting to dynamic, real-time systems. Diversifying liquidity sources also proved essential; depending on a single funding channel leaves businesses vulnerable to systemic risks. Across all examples, embracing technology and diversifying funding channels emerged as key strategies for maintaining regulatory compliance.

These observations highlight a significant shift in compliance strategies, particularly the move from static to dynamic reporting. For instance, a top 10 U.S. regional bank with assets exceeding $120 billion achieved FR 2052a compliance in just two months. They implemented an integrated ALM cash flow engine capable of processing over 1 billion cashflows in roughly three hours. This rapid processing capability demonstrates the value of external ALM solutions, enabling flexible infrastructure that can adapt to evolving regulations. Taras Lytovchenko, Chief Legal and Compliance Officer at Trinitex, emphasized this point:

"The convergence of these factors keeps risk levels high and requires businesses to invest more in proactive compliance, risk management, scenario planning and governance frameworks".

Comparison Table of Strategies

| Company | Core Strategy | Regulatory Focus | Key Outcome |

|---|---|---|---|

| Apple Inc. | Treasury Management Systems | LCR | Strong cash reserves and real-time visibility |

| Walmart Inc. | Centralized Cash Management | NSFR | Improved operational efficiency and stable funding |

| Mid-Sized Banks | Outsourced Cash Management | Basel III / FR 2052a | Enhanced liquidity tracking; 1B+ cashflows in <4 hours |

Practical Recommendations for Businesses

Building on these common themes, businesses can take several actionable steps. Start with a data gap analysis to identify missing elements needed for detailed, transaction-level reporting. Instead of developing systems from scratch, tap into existing data sources like funds transfer pricing, profitability systems, and general ledgers to speed up compliance efforts. Consolidating regulatory and management reporting into a single system can also reduce overall costs and improve data consistency.

However, technology alone isn’t enough. Pair it with robust risk management practices and strong governance to ensure long-term resilience. For companies without in-house expertise, consulting resources like the Top Consulting Firms Directory can help connect with specialists in Basel III, LCR, and NSFR compliance. These measures not only address current regulatory requirements but also prepare businesses for future liquidity management challenges.

The regulatory landscape is becoming increasingly demanding. Between Q1 and Q3 of 2025, business risk levels among compliance officers jumped by 36%. Additionally, 62% of public company board members in 2024 reported that regulations significantly impacted their ability to execute strategies. By integrating RegTech automation with sound governance, organizations can stay ahead of today’s requirements while remaining agile for tomorrow’s regulatory shifts.

Conclusion

Key Takeaways

The case studies highlighted in this article outline a clear roadmap for achieving regulatory compliance in liquidity management. Successful organizations consistently focus on three core strategies: leveraging real-time data systems, establishing centralized governance, and moving from static to dynamic reporting. For instance, a top 10 U.S. regional bank managed to achieve FR 2052a compliance within just six weeks, processing over 1 billion cashflows in three hours. Whether you're addressing LCR requirements like Apple Inc., tackling NSFR compliance like Walmart Inc., or adapting to Basel III as many mid-sized banks are, one thing is clear: outdated systems and fragmented data sources increase both risk and costs. These examples emphasize the value of having specialized expertise to navigate these challenges effectively.

The Role of Expert Guidance

Complying with intricate regulations such as FR 2052a and Basel III often requires a level of expertise that many organizations lack internally. Specialists can help identify data gaps, interpret complex regulatory requirements, and implement tailored solutions efficiently. Recent studies show that regulatory pressures often disrupt strategic execution. Tools like the Top Consulting Firms Directory enable businesses to connect with experts who deeply understand frameworks like LCR and NSFR, offering the technical insights needed for smooth compliance.

Preparing for the Future

As regulations continue to evolve, organizations must brace for increasing complexity. Future demands will likely include greater data granularity, faster reporting timelines, and more advanced stress testing capabilities. Companies that integrate their management and regulatory reporting, ensure clear data lineage, and invest in scalable technology will be better equipped to handle these challenges. Taras Lytovchenko, Chief Legal and Compliance Officer at Trinitex, aptly noted:

"The convergence of these factors keeps risk levels high and requires businesses to invest more in proactive compliance, risk management, scenario planning and governance frameworks".

The shift from reactive compliance to proactive risk management is no longer optional - it's a necessity for maintaining financial stability in an increasingly intricate regulatory landscape.

FAQs

How does Apple manage liquidity to comply with regulatory standards like the Liquidity Coverage Ratio (LCR)?

The Liquidity Coverage Ratio (LCR), established under Basel III regulations, mandates that financial institutions maintain a reserve of high-quality liquid assets (HQLA) sufficient to cover potential net cash outflows during a 30-day period of financial stress. Meeting this requirement hinges on robust treasury management strategies, such as real-time monitoring of cash flows, categorizing assets based on liquidity, and ensuring an adequate buffer of HQLA.

As of now, there’s no publicly available information about Apple’s specific treasury management systems or how they align with LCR requirements. However, if Apple adheres to common industry practices - like automated cash flow forecasting and diligent HQLA tracking - it’s reasonable to assume they would meet these regulatory standards. Still, without direct evidence, this remains an educated guess based on typical compliance approaches.

How does Walmart ensure compliance with NSFR requirements?

Currently, Walmart has not shared any publicly available details about how it plans to meet the Net Stable Funding Ratio (NSFR) requirements. This might be because liquidity regulations are highly specialized, and companies often keep their strategies private. To gain more clarity, you could explore regulatory filings or seek advice from financial experts.

How did mid-sized U.S. banks adjust to Basel III regulations after the collapse of Silicon Valley Bank?

While the Silicon Valley Bank (SVB) collapse has been analyzed extensively, there’s limited information about how mid-sized U.S. banks adjusted their practices to meet Basel III requirements after the incident. What is clear, however, is that the failure of SVB brought greater attention to liquidity management and risk practices across the banking industry. This likely pushed banks to tighten their compliance frameworks and improve oversight of liquidity standards.

The collapse also highlighted the critical need for strong risk management strategies. It prompted financial institutions to reassess their methods for stress testing, capital buffers, and liquidity reserves, aiming to align more closely with Basel III standards and reduce the risk of facing similar challenges.