Digital transformation is reshaping compliance risk management by integrating advanced tools and processes that streamline operations, reduce costs, and enhance risk detection. Key takeaways include:

- Proactive Risk Management: AI-driven systems monitor risks in real-time, identifying threats early and reducing remediation costs by 10%.

- Cost Savings: Automated compliance tools cut SOX compliance costs by 50% and quality assurance expenses by 35%.

- Faster Deployments: Embedding compliance into CI/CD pipelines enables code deployment up to 90% faster.

- Improved Accuracy: Automation reduces errors and regulatory gaps, minimizing risks tied to outdated manual processes.

However, challenges like data security risks, regulatory gaps, and operational hurdles during implementation remain. Addressing these requires early planning, skilled teams, and robust tools.

Quick Tip: Start with a "compliance-by-design" approach, integrating risk management into workflows from the outset to avoid costly delays and inefficiencies.

Re-inventing Internal Controls in the Digital Age | Future of Risk & Compliance

Main Risks in Digital Compliance Transformation

Digital tools hold the promise of transforming compliance processes, but the shift comes with its own set of challenges. With the global average cost of a data breach projected to hit $4.4 million by 2025 and cybercrime damages expected to climb to $10.5 trillion annually by the same year, it’s clear that these risks demand careful attention. Below, we’ll explore the key risks and how to address them effectively.

Data Privacy and Security Risks

The adoption of digital compliance tools significantly increases the potential for cyber threats. Moving to cloud-based platforms, IoT devices, and mobile technologies opens up new vulnerabilities to malware, ransomware, and phishing attacks. The COVID-19 pandemic has only amplified these risks, with many Chief Information Security Officers (CISOs) acknowledging that their defenses fall short against the growing wave of cyber threats.

Third-party vendors add another layer of complexity. When external service providers are integrated into your compliance systems, their security shortcomings can become your problem. For instance, the shared responsibility model in cloud computing often leads to confusion about who handles what. This lack of clarity can leave critical areas unprotected, exposing millions of records and potentially violating regulations like GDPR, CCPA, or HIPAA.

AI-powered compliance tools bring unique risks as well. Issues like algorithmic bias can result in discriminatory decisions, while data poisoning attacks can corrupt the datasets these systems rely on. Without robust transparency and rigorous testing, organizations risk deploying flawed AI systems. However, there’s a silver lining: companies with strong digital risk programs report 65% fewer security incidents and recover 40% faster than those relying on traditional methods.

Regulatory Gaps in New Technologies

Technology often moves faster than regulatory frameworks can adapt. This creates a gray area for organizations implementing cutting-edge compliance tools. Consider this: average annual fines for compliance-related risks exceed $400 million, and regulatory enforcement actions led to approximately $321 billion in penalties worldwide between 2009 and 2016.

"The days of 'build it now and manage the risk later' are over. Risk is too important, not just for banks, but for any company that wants to become more digital." - McKinsey

One of the biggest challenges is that new technologies don’t always align neatly with existing compliance frameworks. Without a system in place to track and respond to evolving regulations in real time, you risk deploying solutions that are compliant today but fall afoul of tomorrow’s rules. Addressing regulatory gaps early can save significant costs - remediating risk-function defects during early stages of technology delivery can cut remediation expenses by 10%.

Operational Risks During Implementation

The implementation phase is where many digital compliance transformations encounter hurdles. If you automate processes that are already broken or poorly defined, you’re essentially just speeding up inefficiencies. In fact, nearly 50% of C-suite leaders and business-unit heads report struggling to fully understand the risks associated with digital transformations.

| Challenge | Effect | Mitigation Strategy |

|---|---|---|

| Skill Gaps | Compliance teams lack technical expertise; tech teams lack regulatory knowledge | Upskill current staff or hire talent with hybrid skills |

| Integration Mismatch | Legacy systems fail to work seamlessly with modern tools, leading to data vulnerabilities | Gradually transition using a "two-speed" architecture |

| Resource Overextension | Relying on part-time compliance support causes delays and errors | Allocate full-time resources to the transformation process |

| Scalability Issues | Temporary solutions create bottlenecks as needs grow | Standardize tools and processes from the start |

Implementing advanced digital tools requires more than just innovation - it demands careful risk management. From system failures to integration challenges, the risks are real, but embedding technology-risk strategies into the planning and delivery stages can help minimize these issues.

"Automating ill-defined or broken processes locks in existing inefficiencies, eroding anticipated cost savings and speed advantages." - Colleen Dowd, Partner, Digital Assurance & Transparency, PwC US

Using RegTech for Automated Compliance

RegTech is transforming compliance processes by automating tasks that were once manual, slashing both time and costs significantly. The industry is on a growth trajectory, with projections showing an increase from $15.68 billion in 2020 to $87.17 billion by 2028. Companies adopting integrated tech and data solutions are already seeing 15%-30% savings in operational compliance costs. This shift is paving the way for advanced risk detection powered by AI.

AI-Powered Risk Detection

Traditional compliance methods relied heavily on periodic audits and static assessments, which often meant identifying issues only after they had occurred. AI-powered RegTech takes a proactive approach, continuously scanning for risks in real time. Instead of waiting for annual reviews, these systems act as 24/7 early warning mechanisms, catching potential risks before they escalate.

The latest AI systems go a step further. Beyond detecting risks, they monitor regulatory updates and automatically adjust internal policies to stay compliant with new requirements. Picture them as virtual regulators, pressure-testing your strategies against existing regulations and enforcement actions, helping you avoid costly missteps.

These tools align perfectly with a compliance-by-design framework, adapting to regulatory changes as they happen. Generative AI now automates tasks like creating suspicious-activity reports (SARs) and updating customer risk ratings when know-your-customer (KYC) attributes change. This "shift left" approach integrates compliance checks into development cycles, identifying issues during agile sprints or CI/CD workflows rather than after deployment. Companies embedding tech-driven risk management in their processes have seen a 50% reduction in defects.

"AI is helping unlock entirely new ways of managing risk and compliance that, until recently, weren't feasible." - PwC

Automated Monitoring and Reporting

Building on real-time risk detection, automated monitoring ensures continuous compliance and rapid responses. Unlike manual monitoring, which leaves gaps between audits, automated systems provide constant oversight, eliminating blind spots and immediately flagging any non-compliance.

Modern platforms simplify compliance by offering multi-framework mapping, which aligns controls across standards like ISO 27001, SOC 2, HIPAA, and GDPR. This eliminates redundant work and ensures consistency throughout the compliance program. Evidence collection is automated, integrating with cloud platforms, HR systems, and identity providers to create a verifiable audit trail without manual intervention.

The impact of RegTech adoption is clear: 95% of companies report satisfaction, with improved compliance being the top benefit. Enforcement statistics highlight the stakes - over $1.3 billion in penalties were issued by the SEC last year, with 1,558 enforcement actions occurring in just one recent 30-day period.

Kelly Housh, a consultant at Bremer Bank, shared her perspective:

"Every word makes a difference in regulatory compliance ... so how it applies is very specific to your organization. Having Compliance.ai's software definitely makes my job more efficient."

Third-Party Risk Management Tools

Third-party vendors often pose significant compliance challenges. When external partners connect to your systems, their vulnerabilities can become your liabilities. RegTech addresses this by automating vendor assessments and enabling continuous monitoring rather than relying on static, periodic reviews.

In today’s interconnected systems, monitoring vendor risks is as critical as managing internal compliance. These platforms utilize automated surveys and questionnaires to gather key supplier information, linking it to business continuity and disaster recovery plans. The result? A centralized dashboard offering a complete view of third-party risks - spanning operational, financial, reputational, and compliance areas. Companies with strong digital risk management programs experience fewer security incidents and recover faster when issues arise.

Advanced eKYC and AML tools further enhance compliance by aggregating data from multiple sources, creating a real-time, audit-ready repository. For organizations without structured digital risk management, compliance costs are 45% higher. Investing in these tools not only mitigates risks but quickly pays for itself.

How to Integrate Digital Compliance Successfully

Integrating compliance into your digital transformation isn’t just a good idea - it’s essential. Without proper planning, organizations risk inefficient processes and heightened security vulnerabilities. To succeed, compliance must be treated as a key design principle from the outset, not an afterthought. Below, we’ll break down actionable steps to weave compliance into impact assessment, vendor management, and continuous improvement.

Impact Assessment and Planning

Start by establishing a formal intake process for every digital compliance initiative. This means defining the project’s scope, identifying relevant laws and regulations, and involving the right internal stakeholders from day one. A structured intake process can streamline operations and automate compliance tracking, saving time and effort.

Adopting a "shift left" approach is another game-changer. By conducting risk assessments early - during agile sprints or CI/CD workflows - you can address issues before deployment. This proactive strategy has been shown to reduce defects by 50% and cut remediation costs by around 10%. To make this work, assess whether your compliance team has the necessary technical expertise or if you’ll need to bring in or train tech-savvy professionals.

Focus your efforts on high-impact areas, such as credit underwriting or anti-money laundering (AML), where digitization can significantly reduce risks. These initiatives aren’t just about compliance - they’re cost-effective too, with the potential to lower operational costs for risk activities by 20% to 30%.

Vendor Risk Management Frameworks

Managing vendor risks effectively starts with a standardized approach. Create a unified risk taxonomy that categorizes third-party risks - like cybersecurity, privacy, and operational threats - consistently across your organization. Decide early on how your compliance team will interact with technology development. Will they provide occasional advisory support, or will they be embedded within the development process? An embedded model allows for real-time feedback and ensures compliance issues are addressed during development, not at the last minute.

Before launching any vendor integration, conduct thorough operational readiness checks. This includes testing system capabilities, updating internal policies, and training teams on new workflows. These steps reduce the likelihood of compliance gaps emerging post-launch. It’s worth noting that 59% of Chief Compliance Officers now prioritize cybersecurity and data privacy in their budgets to address risks tied to digital vendors.

Continuous Improvement and Feedback Loops

Static compliance reviews are no longer enough. Modern solutions leverage AI and machine learning to monitor regulatory changes, enhance risk detection, and reduce false positives. Integrate compliance into performance management by setting risk-related OKRs (Objectives and Key Results). Metrics like "time to remediation" or "open remediation activities" can help hold teams accountable and keep compliance on track.

A centralized dashboard - a single source of truth - can further streamline the process. Tracking all identified risks and remediation efforts in one place allows you to identify recurring issues and address process weaknesses efficiently.

"Risk and compliance teams who seize this moment will position themselves for a very different future. By scaling their capabilities with automation, risk-signal monitoring, agentic solutions, and real-time insights... these teams can evolve into highly strategic advisors to the business." - PwC

sbb-itb-97f6a47

Case Studies: Compliance Risk Transformation Examples

Industry-Specific Case Studies

These examples show how digital tools are helping different industries tackle compliance risks effectively.

Financial Services: In 2024, Penguin Securities, a financial services provider based in Singapore, adopted Moody's Maxsight platform to digitize its customer onboarding process. This shift to automation cut onboarding time by an impressive 70–80%. Chief Compliance Officer Shelly Harding shared her perspective:

"Maxsight™ has transformed the way we manage compliance, allowing us to enhance due diligence while significantly reducing onboarding time."

Another standout example is BitPay, a leader in blockchain payments, which turned to Passfort in 2020 to streamline its KYC (Know Your Customer) processes. The results? An 89% Straight Through Processing (STP) rate, a reduction in new application Time to Decision (TTD) to just 3 minutes, and a 9% bump in approval rates. This initiative was spearheaded by Senior Product Manager Yamini Sagar.

Wealth Management: St. James's Place took a similar step by integrating Passfort Lifecycle with GBG data checks to automate customer due diligence. Over two years, the firm onboarded more than 150,000 customers and increased its customer pass rate by 9%. The project was led by Deputy MLRO Gavin Welch.

Meanwhile, a major US bank reimagined its risk processes by embedding a senior product owner from the second line of defense into its transformation team. This change reduced governance review groups from 33 to seven and integrated risk requirements into Jira backlogs. The results were striking: the risk-approval timeline dropped from 180 days to around 40, compliance artifacts were cut by 40% through automation, and overhead was slashed by 85%.

Technology Sector: Sophos, a cybersecurity company, implemented the Whatfix Digital Adoption Platform (DAP) to boost global Salesforce adoption. The initiative yielded a 15% reduction in sales operations support tickets (about 12,000 fewer tickets), saved 1,070 hours of manual work, and delivered a 342% ROI.

These examples not only showcase measurable improvements but also highlight the strategic moves behind successful compliance transformations.

Lessons Learned from Implementation

There are clear patterns behind these success stories. Embedding compliance into the early design stages and refining processes before automation are essential steps to unlocking the full potential of digital transformation.

Involving compliance teams early can prevent costly delays and improve risk management. For instance, a midsize bank aiming for a cloud-native transformation in 2021 faced a five-month delay when regulatory examiners flagged deficiencies. This highlighted the need to modernize risk and security functions alongside technology upgrades.

Process optimization should always come first. One European bank, overwhelmed by rising AML (anti-money laundering) headcounts, began by implementing process management tools to handle alerts across different business units. Only after this groundwork was laid did they introduce machine learning to enhance detection algorithms. This staged approach tripled the speed of Level 1 alert handling and doubled the speed for Level 2.

McKinsey & Company summed it up well:

"A revenue boost of $200 million generated by a digital transformation doesn't mean much if a company is fined $300 million in related risk-violation penalties".

The main takeaway? Technology alone won’t fix broken systems. Companies need to prioritize compliance-by-design principles, upskill teams with both technical and compliance expertise, and ensure they’re operationally ready before launching. This includes updating policies, coordinating across teams, and providing thorough training.

Benefits and Implementation Roadmap

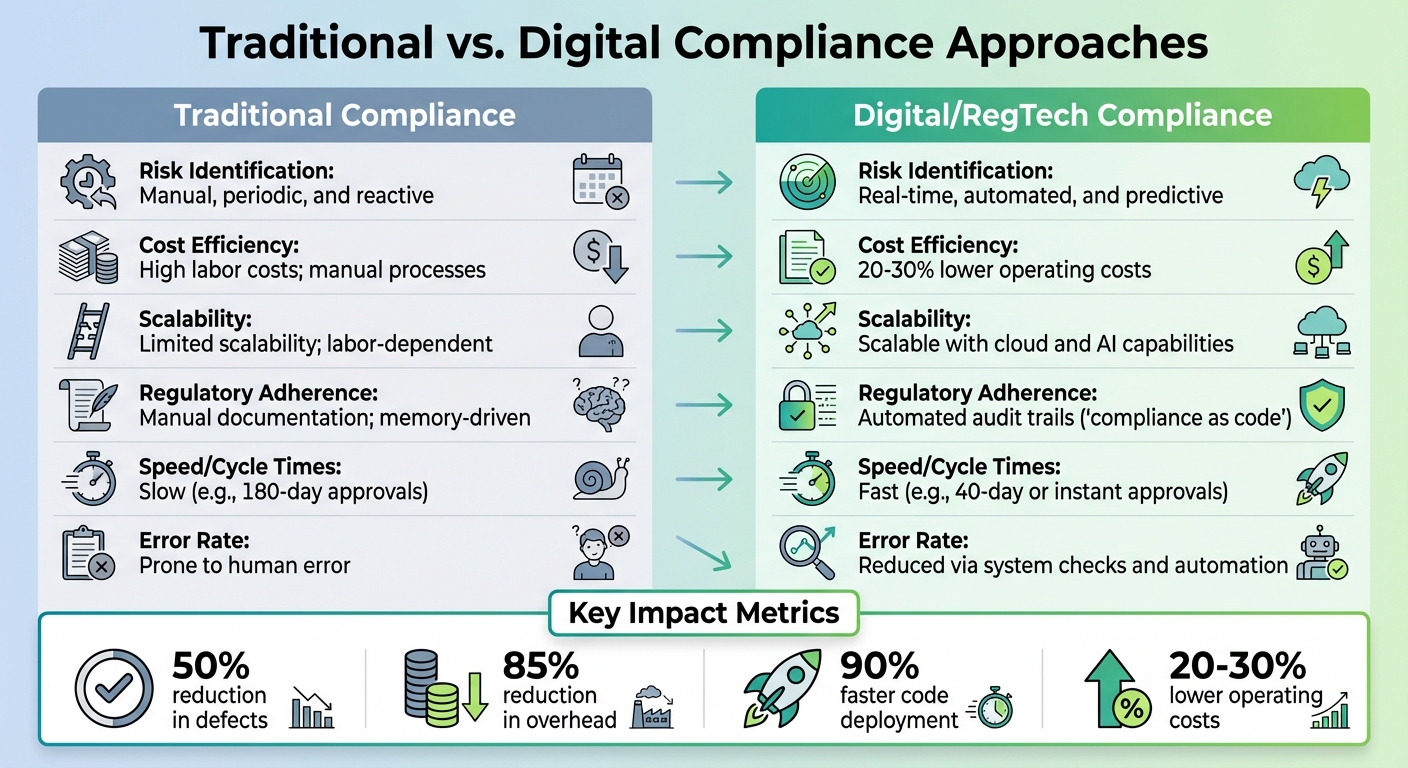

Traditional vs Digital Compliance: Cost Savings and Efficiency Comparison

Traditional vs. Digital Compliance Approaches

Traditional compliance methods are often manual, slow, and require significant resources. On the other hand, digital compliance automates tasks, monitors risks in real time, and significantly reduces costs.

For example, digital initiatives can lower operating costs by 20–30% and cut defects by half. One financial institution achieved an 85% reduction in overhead by embedding risk requirements into Jira backlogs. They also slashed their risk-approval timeline from 180 days to roughly 40.

| Feature | Traditional Compliance | Digital/RegTech Compliance |

|---|---|---|

| Risk Identification | Manual, periodic, and reactive | Real-time, automated, and predictive |

| Cost Efficiency | High labor costs; manual processes | 20–30% lower operating costs |

| Scalability | Limited scalability; labor-dependent | Scalable with cloud and AI capabilities |

| Regulatory Adherence | Manual documentation; memory-driven | Automated audit trails ("compliance as code") |

| Speed/Cycle Times | Slow (e.g., 180-day approvals) | Fast (e.g., 40-day or instant approvals) |

| Error Rate | Prone to human error | Reduced via system checks and automation |

Speed is another key advantage. Tasks like Know Your Customer (KYC), which used to take a week, can now be completed in under a day. Automated security checks also allow organizations to deploy new code 90% faster than traditional manual reviews. As McKinsey emphasizes:

"The days of 'build it now and manage the risk later' are over. Risk is too important, not just for banks, but for any company that wants to become more digital."

With these benefits in mind, a structured roadmap is essential for implementing digital compliance effectively.

Step-by-Step Guide to Implementing Digital Compliance Tools

A clear and structured plan is crucial for adopting digital compliance tools without unnecessary delays or wasted resources.

Start with strategy and impact assessment. Develop a digital transformation strategy that includes compliance goals. Begin with a formal intake process to evaluate the risk profile of your initiatives and identify which regulations or policies will be impacted.

Embed compliance early using a "shift left" approach. Involve compliance professionals from the start of projects, such as during quarterly business reviews or release planning sessions, to ensure alignment across teams.

Standardize and automate processes. Use a scalable framework to manage compliance risks, ensuring all regulatory requirements and policies are properly documented. Automate tasks like regulatory change management and risk matrix mapping, but be sure to fix broken processes before automating them.

Test rigorously and monitor readiness. Define clear success criteria and monitor complaint trends before launching new tools. Update internal policies, procedures, and customer-facing materials alongside new technology deployments.

Continuously optimize and measure ROI. Treat compliance as an ongoing investment. Use data to demonstrate return on investment (ROI) to leadership and build risk-related Objectives and Key Results (OKRs) into performance metrics, such as tracking "time to remediation".

A key tip: dedicate full-time compliance experts. Organizations that excel at balancing innovation with risk management make compliance a full-time focus. Upskilling is also critical - train risk experts in agile methodologies or teach tech architects about risk management principles.

Once your framework is in place, consider leveraging external expertise to fine-tune your approach.

Finding Expert Support Through Top Consulting Firms Directory

Digital compliance transformation can be complex, often requiring specialized expertise. The Top Consulting Firms Directory is a valuable resource for finding expert partners to help modernize your risk management processes and enhance your team’s skills.

When selecting a consulting partner, prioritize firms with experience in your industry, a proven track record in RegTech implementations, and a focus on empowering your internal teams for long-term success.

Conclusion: The Future of Compliance Risk Management

Key Takeaways for Business Leaders

The rise of digital transformation is reshaping how companies approach compliance risk management. Businesses that seamlessly integrate compliance into their technology not only reduce costs but also speed up approval processes. In fact, organizations that proactively assess the risks tied to digital transformation report a 75% improvement in their ability to understand and manage risks.

Moving away from reactive approaches to a "compliance-by-design" model doesn’t just save money - it also strengthens a company’s ability to navigate an unpredictable regulatory environment, where annual fines can exceed $400 million. Compliance is no longer just a back-office function; it’s becoming a strategic asset. As Boston Consulting Group highlights, "The most effective compliance teams of the future will skillfully combine risk and operations expertise with advanced technological capabilities". To keep pace, companies need to invest in upskilling their teams in areas like data analytics, AI oversight, and agile methodologies. Treating compliance as a full-time, strategic priority is key to staying ahead.

These insights call for immediate action to future-proof your compliance strategy.

Start Your Transformation Journey

Delaying updates to your compliance framework comes with serious risks - rising penalties and the loss of competitive edge. Businesses that act now have the chance to transform compliance from a regulatory burden into a strategic advantage.

Start by conducting a thorough compliance health check to identify gaps in your current processes. Develop structured systems to evaluate digital initiatives, implement automated controls where feasible, and tie risk metrics directly to your performance management goals. For expert guidance on this journey, explore the Top Consulting Firms Directory. The future belongs to companies that embed strong risk management practices into the foundation of their digital strategies.

FAQs

How does AI enhance real-time compliance risk detection?

AI-powered systems leverage machine learning and generative AI models to process massive amounts of transaction and behavioral data in real time. These advanced tools can swiftly detect unusual patterns, cross-check them against regulatory guidelines, and trigger alerts, enabling organizations to act on potential risks without delay.

By automating these tasks, AI minimizes the need for manual intervention, enhances precision, and allows compliance teams to concentrate on solving high-priority challenges instead of combing through endless data. This not only streamlines operations but also reinforces an organization's capacity to adhere to regulatory standards efficiently.

What challenges do businesses face when adopting digital compliance tools?

Adopting digital compliance tools isn't always straightforward. Many organizations face hurdles like outdated systems, reliance on manual processes, and the inevitable growing pains of organizational change. Legacy systems, for instance, often struggle to sync with modern, data-driven platforms, creating inconsistencies in data flow and gaps in control coverage. On top of that, manual workflows - still used by many teams - can bog down digital progress and leave room for oversight errors.

Another significant challenge lies in shifting team mindsets and skillsets. To use automation, analytics, and AI effectively, employees need proper training and guidance. At the same time, governance structures must evolve to align with digital-first environments. This means updating policies, clarifying who owns which controls, and implementing continuous monitoring practices that fit the new landscape.

To tackle these issues, businesses should consider a compliance-by-design strategy. By embedding regulatory requirements from the start, leveraging integrated analytics, and encouraging collaboration between IT, risk, and business units, companies can transform compliance from a stumbling block into a strategic advantage.

How can RegTech help businesses lower compliance costs?

RegTech helps businesses cut compliance costs by automating tasks that traditionally eat up time and resources. For instance, it can handle monitoring regulatory updates, aligning them with internal policies, and sending real-time alerts. This means no more manual processes like tracking changes in spreadsheets, significantly reducing the effort and expense tied to compliance reviews. Technologies like machine learning and natural language processing also streamline critical processes, such as anti-money laundering checks, Know-Your-Customer verifications, and regulatory reporting, making them faster and more efficient.

Another major benefit is the creation of standardized digital audit trails. These make collecting evidence easier and audit cycles shorter, which can help businesses avoid hefty penalties. Real-time monitoring further adds value by spotting compliance gaps early, saving companies from costly remediation efforts. By leveraging these data-driven solutions, businesses can downsize their compliance teams and redirect resources toward strategic goals, potentially saving thousands of dollars every year.

For organizations looking to implement RegTech effectively, the Top Consulting Firms Directory is a great resource. It offers a carefully selected list of firms specializing in digital transformation and regulatory technology, helping businesses find the right partners for cost-efficient compliance solutions.